Many buyers ask where my packaging comes from. They want clarity. They want control. I agree. I show the full path from fiber to finished display.

My packaging is produced in Shenzhen, China, in my audited network of paper mills, printers, and converters. I also use backup partners in the US and EU for rush or compliance needs, and I document factory details, certifications, and origin labels for every order.

You may want more than a short answer. You want to know where the fiber starts, how the board is made, why some countries lead, and how "country of origin" works. I will explain all that now with simple steps, clear checks, and real options.

Where does packaging come from?

Many people think a display appears overnight. It does not. It starts with fiber, then turns into board, then becomes a display you can touch.

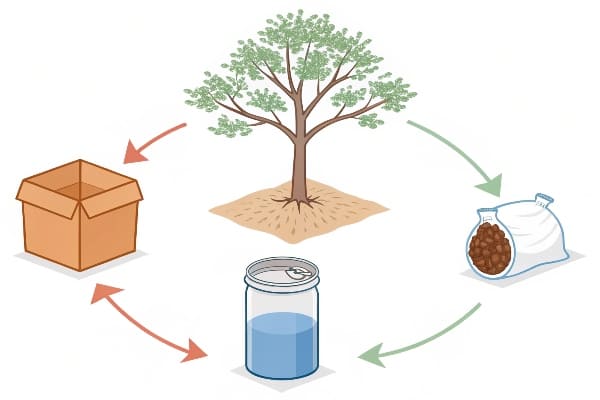

Most packaging starts with fiber from forests or recycled streams, moves to paper mills that make liner and medium, then corrugators and printers turn sheets into parts, and final kitting creates flat-pack displays ready for stores.

The supply chain in simple steps

I use a simple view when I plan a program. Fiber becomes paper. Paper becomes board. Board becomes parts. Parts become a display. Each step adds value. Each step adds risk if we skip checks.

What to check at each step

I track who owns each step, what changes to the material, and what proof I need before I pay. I ask for mill reels, sheet specs, print drawdowns, and transit test data. I lock ICC profiles for color. I lock ECT and BCT targets for strength. When I do this, I sleep well and my clients do too.

| Stage | Owner | What Happens | What To Verify | Typical Lead Time | Common Risk |

|---|---|---|---|---|---|

| Fiber sourcing1 | Forestry / Recyclers | Virgin pulp or recycled fiber | FSC/PEFC docs, recycled content | 1–3 days | Origin claims not tracked |

| Papermaking2 | Paper mill | Liner/medium produced | GSM, moisture, reel IDs | 3–5 days | Moisture too high |

| Corrugating / Laminating | Board plant | Sheets made, top-sheet mounted | ECT/BCT, flute profile | 2–4 days | Warp and crush |

| Printing3 | Converter / Printer | Offset or digital print | Color proof, ICC match | 2–5 days | Color shift |

| Die-cut / Glue | Converter | Parts cut and formed | Knife rule, fold tests | 2–4 days | Tear at folds |

| Kitting / Pack | Assembler | Hardware, inserts, flat-pack | BOM accuracy, count | 1–3 days | Missing parts |

| Freight4 | 3PL | Export / domestic | ISTA pack, pallet spec | 7–35 days | Transit damage |

I keep this map simple. I share it with buyers and retail partners. Everyone sees the same plan and the same proof.

How is packaging manufactured?

I start with a CAD drawing. I test a sample. I fix weak spots. Then I run the line with the right board grade and print plan.

Manufacturing follows five basics: design in CAD, sample and test, print and laminate, die-cut and glue, then kit and flat-pack. I lock specs, color, and strength at each gate to avoid delays and rework.

The step-by-step flow I use

I design the structure in CAD with your product sizes. I add safety gaps for hooks, trays, and edge crush. I cut a white sample on a plotter. I load it with your product. I push, pull, and tilt it. I add a printed sample next. I check for color in real light. I sign off ECT and BCT. I run pilot boards to watch warp and glue. Then I open the full run.

Tools, checks, and why they matter

I do offset when I need fine images and tight color. I do digital when I need speed, short runs, or variable data. I laminate top sheets on corrugated to get a premium face with a strong core. I track glue lines and fold memory. I pack as flat as I can to save freight and cut damage.

| Step | What We Do | Tools | QC Gate | Why It Matters |

|---|---|---|---|---|

| CAD Structure5 | Fit product, locks, weight | ArtiosCAD/CAD table | Fit test | Prevents lean and collapse |

| White Sample | Cut and fold | Sample table | Assembly test | Finds weak folds early |

| Print Proof6 | Color and finish | Offset/Digital draws | Delta E check | Stops brand color drift |

| Lamination7 | Mount top sheet | Sheet-to-sheet lam | Peel test | Prevents face bubbles |

| Die-Cut | Cut parts | Flatbed/rotary die | Knife wear check | Clean edges, fast build |

| Gluing | Form trays/tabs | Auto-gluer, hotmelt | Bond strength | Stops seam failures |

| Kitting | Add hooks/inserts | Manual line | BOM audit | Zero missing parts |

| Pack & Ship8 | Flat-pack, pallet | ISTA pack spec | Drop/tilt check | Fewer transit claims |

I keep the line simple. I remove steps that do not add value. I share photos and videos during runs. I fix issues on the spot. I know deadlines are hard. I plan buffers so you can launch on time.

What country produces the most packaging?

I get this question in most calls. People want the big picture. They want to match the source to risk, cost, and speed.

China produces the most packaging by volume, followed by the United States and the European Union. India and Southeast Asia are growing fast. Choice depends on speed, compliance, tariffs, and total landed cost, not volume alone.

Why China leads, and where others shine

China has deep fiber imports9, huge mill capacity, and many converters. Tooling is fast. Labor is flexible. Supply chains are dense. Prices stay sharp because plants run full. The US and EU lead in compliant materials10, advanced print lines, and strict audits. Lead times can be shorter for domestic programs. India and Vietnam add capacity each year. They bring good costs for simple SKUs and fast growth for basic grades.

How I choose a country for your program

I look at launch date, units, display size, and duty. I model freight time and risk. If time is tight, I use a mixed plan: core in China, rush or reprint in the US or EU. If compliance is key, I choose plants with the right audits and inks. If tariffs spike, I shift to a second source in another country. In 2025 some buyers assume tariff rates11 on certain Chinese goods can reach about 30% in planning models. I always check current rates before I quote. I never rely on old numbers.

| Region | Strengths | Risks | Best For | Typical Lead Time | Notes |

|---|---|---|---|---|---|

| China | Scale, cost, speed to tool | Tariffs, ocean time | Large rollouts, custom shapes | 25–45 days to DC | Deep vendor pool in Shenzhen |

| United States | Compliance, quick ship | Higher unit cost | Rush jobs, strict retail tests | 7–14 days to DC | Great for reprints |

| European Union | Print quality, sustainability | Cost, capacity spikes | Premium finishes, EU retail | 10–20 days | Strong eco labels |

| India/Vietnam | Cost, growing base | QC variance | Simple SKUs, long windows | 30–50 days | Needs tight QC plan |

This is how I explain the trade-offs. There is no single "best" country. There is only the best mix for your launch.

What is the country of origin on packaging?

Labels confuse many teams. They see pulp from one place, paper from another, and printing in a third. They ask what to print on the box.

Country of origin usually means the place of substantial transformation. For displays, that is where printing and converting turn sheets into the finished display. It is not the pulp source.

What "substantial transformation12" means in plain words

Origin points to the country where the main change happens. When flat sheets become printed, die-cut, glued parts, the product becomes a new thing. That country is the origin for most markets. Raw fiber origin does not set the label. A reel that moves across borders does not change origin until a real process creates a new good.

Common mistakes I help buyers avoid

Teams mix "ship-from" with origin. They put "Made in EU" when only the warehouse is in the EU. Others mix "designed in" with origin. Design location does not set origin. Some split sets across countries and still print one origin. Sets may need multi-country wording or a dominant origin. I review the bill of materials and the workings. I keep the label clean and honest.

How labeling differs by market13, and how I document it

Rules vary by country. The core idea stays the same. I do not give legal advice. I follow buyer counsel and retailer rules. I prepare a pack with process photos, invoices, and test reports. I add FSC or recycled claims only when I hold valid chain-of-custody proof14. I never over-state.

| Market | Rule of Thumb | Docs Usually Needed | Risk If Wrong | My Tip |

|---|---|---|---|---|

| United States | Substantial transformation sets origin | Process flow, invoices, factory letter | Detention, relabel, fines | Align with importer of record |

| European Union | Last substantial process sets origin | Supplier declarations, COC | Customs delay | Match CN code logic |

| United Kingdom | As above, post-Brexit customs | Supplier origin statement | Border checks | Keep SKU-level logs |

| Australia | Clear and true claims only | Evidence of processes | ACCC action | Avoid vague wording |

I print the label only after you approve the origin memo. I keep the memo with photos and batch IDs. I store it with your PO. If audits come, I can respond fast.

Conclusion

Your packaging comes from a chain. I map it, I test it, and I mark origin clearly so you can launch on time with no surprises.

Explore this link to understand effective fiber sourcing strategies that ensure sustainability and quality. ↩

Learn about essential quality checks in papermaking to enhance product reliability and performance. ↩

Discover common printing challenges and solutions to ensure high-quality output in your supply chain. ↩

Find out best practices for freight management to minimize risks and ensure timely delivery. ↩

Understanding CAD Structure is crucial for ensuring product fit and stability, preventing potential failures. ↩

Exploring Print Proof helps in maintaining brand color consistency and quality in printed materials. ↩

Lamination enhances the durability and appearance of packaging, preventing issues like face bubbles. ↩

Learning about Pack & Ship best practices can significantly reduce transit claims and improve delivery efficiency. ↩

Explore how deep fiber imports can enhance production efficiency and cost-effectiveness in manufacturing. ↩

Learn about the significance of compliant materials in ensuring product safety and regulatory adherence. ↩

Stay informed about tariff rates to make better sourcing decisions and avoid unexpected costs. ↩

Understanding substantial transformation is crucial for accurate product labeling and compliance with international trade laws. ↩

Explore how labeling regulations vary by market to ensure compliance and avoid costly mistakes in international trade. ↩

Learn about chain-of-custody proof to ensure your product claims are valid and trustworthy, enhancing your brand's credibility. ↩