I run a display and packaging shop. I sell to brands that need fast retail impact. I work with tight timelines, long print runs, and strict tests. I know why some boxes cost more. I also know where to cut waste.

Custom rigid boxes are expensive because they need premium boards, hand assembly or slow automation, multiple print and lamination passes, tight color control, and high scrap risk. Small runs push unit cost up, shipping and duties add more, and quality checks take time.

I want to help you choose well. I use simple terms. I explain cost blocks and trade-offs. I share a quick story from my floor. Then I line up options so you can match budget, speed, and brand goals.

Why are custom boxes so expensive?

I hear this line each week. A buyer likes the design. Then the quote lands. The number feels high. The deadline is close. I break down the parts. I show where the money goes. Then we plan a smarter spec.

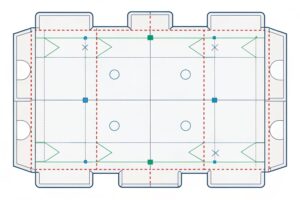

Custom boxes cost more because every choice is unique: dielines, inserts, finishes, and artwork all change setup time, waste, and yield; short runs spread fixed costs over fewer units; premium print methods and strict QC add labor, while rush schedules increase overtime and freight.

What really drives the price

I keep the math clear. A box price has fixed and variable parts. Fixed parts include structural design, CAD cutting, tooling for dies, color calibration, and press setup. Variable parts include board, ink, glue, films, and labor. When a buyer orders 500 units, the setup cost spreads over 500. When a buyer orders 5,000, the setup cost1 spreads over 5,000, so the unit price drops fast. I often show two brackets: pilot and scale. The pilot proves strength and color. The scale pays the profit.

I walk through finishes next. Spot UV, foil, and soft-touch look great, but each adds passes and drying time. Each pass adds scrap risk. Scrap means we print extra to hit the final good count. That raises both time and cost. Inserts matter too. Foam trays, molded pulp, or corrugated cradles each has a different die and assembly path. My team tests loads and edge crush so the pack survives long truck lanes.

I give one story. A seasonal launch2 had five SKUs and strict greens. The brand asked for heavy foil on all panels. We moved foil to the lid only and kept soft-touch inside. We saved 14% and kept the shelf look. The pieces still passed drop and humidity tests.

| Cost Block | What It Includes | How To Lower |

|---|---|---|

| Setup | Dieline, plates, calibration | Combine SKUs, raise run size |

| Materials | Board, liners, films | Use lighter board with smart ribs |

| Finishes | Foil, UV, varnish | Limit to high-impact zones |

| Inserts | Foam, pulp, corrugated | Use die-cut corrugated |

| QC & Testing | Color, strength, transit | Approve a golden sample fast |

| Logistics | Freight, duty, packing | Flat-pack where possible |

Are rigid boxes expensive?

Many buyers link “rigid” with “luxury,” so they expect a high tag. That is often true. It is not always true. I compare many specs each month. I can show when rigid makes sense and when it does not.

Rigid boxes are usually more expensive than folding cartons or corrugated units because they use thicker boards, wrapped covers, and more hand work; they pay off for luxury unboxing and high retail margins but not for price-sensitive, high-volume programs.

When rigid is worth it, and when it is not

I start with structure. A rigid setup box3 uses greyboard wrapped with printed paper. Corners need tape or wrap folds. Lids need precise fit. Tolerances are tight. Many steps run by hand or slow jigs. By contrast, a folding carton runs fast on automated lines. Corrugated runs even faster and ships flat. So the labor gap is real.

I look at margins next. If your product has strong gross margin and the brand story depends on a premium unbox, rigid pays back. I see this in beauty, small electronics, and gifts. If your item is a price fighter in mass retail, rigid rarely wins. A smart litho-laminated corrugated box with nice printing and a clean insert often hits 80% of the look at 50–70% of the cost.

Sustainability is part of the call. Wrapped boards can mix materials and glues that slow recycling. I offer mono-material wraps and water-based glues. I sometimes move the spec to thick SBS or E-flute with tight graphics. In North America, demand is stable and retail is mature. In Asia-Pacific, volume grows fast with urban retail and e-commerce. Buyers there push for speed and cost, so corrugated often wins. In Europe, many buyers favor recyclable packs. That again pushes folding or corrugated, unless luxury is key.

| Option | Unit Cost | Speed | Look & Feel | Recyclability | Best For |

|---|---|---|---|---|---|

| Rigid Setup Box | High | Slow | Premium | Medium-High (design-dependent) | Luxury, gifting |

| Folding Carton | Medium | Fast | Good | High | Beauty, pharma |

| Litho-Lam Corrugated | Medium-Low | Very Fast | Strong shelf impact | High | POP, shipping+display |

Why are custom music boxes so expensive?

This question comes up in gift seasons. A music box looks small and cute. The price feels high. The reason sits in two parts: the box and the mechanism. Both must match. Both must survive shipping. Both must still sing after a drop.

Custom music boxes cost more because they combine precision mechanisms with tight-tolerance packaging, acoustic tuning, and premium finishes; low volumes and high failure risk increase scrap and rework, while testing for sound, vibration, and transit adds time and labor.

The mechanism, the box, and the tests

I scope the mechanism first. A quality musical movement4 needs consistent torque, gear mesh, and spring strength. If the housing flexes, the sound wobbles. If the mount is loose, the tune rattles. So we design the cavity and insert to hold load paths steady. Foam feels simple, but wrong density kills resonance. Molded pulp is green, but it needs tight walls. Die-cut corrugated gives control at scale. We test all three.

We print with care. Music gifts want foil, emboss, or soft-touch. These add beauty and also cost. On a small run, each extra pass hits unit price hard. We place finish only where the eye lands. We keep the back and base simple. We lock color early with a golden sample.

We run more tests. A music piece hates shock and moisture. We do drop tests, humidity soak, and vibration. We pack shippers to cut corner crush. We keep the gram weight high enough for safety, low enough for freight. I had one case where a client wanted a glass window on the lid. We ran three prototypes. The third moved glass to a framed PET window with scratch-resist coating. It saved weight, cost, and claims. The tune still rang clear.

| Cost Driver | Why It Adds Cost | Mitigation |

|---|---|---|

| Musical Mechanism | Precision parts, QC rejects | Choose proven movements, audit suppliers |

| Acoustic Design | Inserts, cavity tuning | Use standard cavity set with minor tweaks |

| Finishes | Extra passes, scrap risk | Focus on lid and logo zones |

| Testing | Drop, humidity, vibration | Combine tests in one pilot run |

| Freight | Padding, double wall shippers | Flat-pack parts where possible |

What are the disadvantages of rigid boxes?

Rigid boxes look great. They tell a premium story fast. They also have limits. I explain these early so no one is surprised later in the project. Clear trade-offs help us ship on time and on budget.

Rigid boxes have higher unit cost, slower lead time, more storage volume, and tighter tolerance risk; they can complicate recycling, and they are less forgiving in transit than corrugated or folding cartons, so they need more protective packing and careful QC.

The trade-offs I see on the factory floor

I see four main drawbacks. First is cost. Thick boards, wrap paper, and hand work add up. If the forecast is small, the unit price climbs. Second is speed. Setup boxes move through more stations. Any rework slows the line again. Folding cartons and corrugated packs run faster and recover easier from a change.

Third is space. Rigid boxes ship and store as full volume. A pallet holds fewer units. Warehousing costs rise. Corrugated and folding styles ship flat. They save a lot of space. Fourth is recycling. Many rigid boxes use films, foils, or mixed wraps. These look nice but can slow the fiber stream. I now push water-based inks and mono-material wraps where the brand allows.

I add two more notes. Tolerances are tight for lids and bases. A small drift can cause fit issues. We watch humidity and board swell. Also, transit shock can chip corners. We add edge protection, stronger outers, or move to a hybrid spec: printed wrap on E-flute with reinforced corners. In my North America orders, demand is steady for gift seasons. In Asia-Pacific, growth is fast, driven by retail expansion and e-commerce. In Europe, buyers ask more for recyclable builds. I shape the spec by market so the brand wins on shelf and budget.

| Disadvantage | Impact | Workaround |

|---|---|---|

| Higher Cost5 | Budget pressure | Limit finishes, raise run size |

| Slower Lead Time6 | Missed launch risk | Lock artwork early, freeze scope |

| Bulky Storage7 | Higher warehousing and freight | Ship components flat when possible |

| Recycling Complexity8 | Compliance risk | Mono-material wraps, water-based ink |

| Fit Tolerance | Lid/base mismatch | Tight QC, climate control |

| Corner Damage | Retail claims | Edge guards, stronger shippers |

Conclusion

Rigid boxes look premium but cost more due to materials, labor, finishes, and risk. I match the spec to margin, timeline, and market so the brand wins without waste.

Understanding setup costs can help you optimize production and reduce overall expenses. ↩

Exploring strategies for seasonal launches can enhance your marketing efforts and improve product visibility. ↩

Explore the benefits of rigid setup boxes, especially for luxury items, to understand their value in premium packaging. ↩

Understanding musical movements is crucial for creating quality sound. Explore this link to deepen your knowledge. ↩

Understanding the implications of higher costs can help businesses strategize better and optimize their packaging processes. ↩

Exploring solutions for lead time reduction can enhance efficiency and ensure timely product launches. ↩

Learning about effective storage management can significantly reduce warehousing costs and improve space utilization. ↩

Gaining insights into recycling challenges can help brands adopt more sustainable practices and comply with regulations. ↩