I see shoppers rush, glance, decide, and leave. I need a display that stops them fast. I also need cost control. I ask if POP still works.

Yes. POP displays still drive lift when they match the store, the shopper, and the offer. They work best when design is simple, setup is quick, and data guides placement. They fail when they are fragile, off-brand, or late.

I will show what works now. I will also share a short story from my own factory floor. I will keep the ideas clear and useful. Then you can act today.

What are the pros and cons of pop displays?

Shoppers do not read long signs. They see color and shape. They touch. They take. A good POP display can win this moment. A weak one can lose it.

The pros are impact, speed, and cost control; the cons are durability, setup risks, and waste. Cardboard POP wins for price, speed, and custom fit. It loses for long wear or wet areas. Good design and better testing reduce most issues.

A practical look at upsides and tradeoffs

I work in cardboard displays. I build designs for FMCG, beauty, toys, and electronics. I ship to the U.S., Canada, the U.K., and Australia. I see simple rules hold. Cardboard is flexible1. It is easy to cut, print, and fold. It speeds small runs. It fits many shapes and brand needs. Digital print helps short lead times and personal designs. That is why brands still ask for it. North America is a steady and mature market. Asia Pacific grows fast. Retail spreads in China, India, and Southeast Asia. More stores push demand. Europe asks for green design and recycled content2. So I plan specs by region.

Cost sits first3. Cardboard is cheaper than metal or plastic. It is perfect for seasonal pushes and short promos. It also ships flat. It sets up fast. This saves labor. These are clear pros. The cons are real. Cardboard can fail in wet or high touch zones. Complex structures can break in transit. Color drift can hurt brand trust. I use load tests, transport tests, and film wrap to reduce damage. I track pulp prices. They swing and hit margins. I keep backup board grades and converters.

I measure five factors: impact, setup time, unit cost, shelf life, and recycling4. I use a simple risk map. If a display must last months, I add coatings or hybrid parts. If it runs four weeks, I keep it light. I keep graphics bold with big fonts and clear claims. Here is a quick view:

| Factor | Big Pro | Big Con | My Fix |

|---|---|---|---|

| Impact | Large panels and color | Can block aisles | Size to planogram |

| Cost | Lower than plastic/metal | Pulp price swings | Tiered board grades |

| Speed | Digital short runs | Rush errors | Pre-flight checklists |

| Setup | Flat-pack, tool-less | Store team variance | Photo guides + QR video |

| Eco | Recyclable | Wet strength limits | Water-based inks, nano coatings |

What is the point of purchase pop display?

The point of purchase is the place of choice. It is where my display must convert. It must make the shelf easy. It must make the price clear.

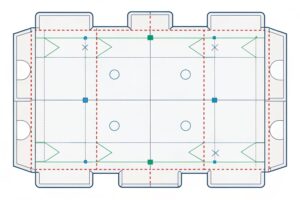

A POP display is a temporary or semi-permanent unit placed where shoppers decide. It organizes stock, tells a simple story, and asks for action. It can be a floor stand, a countertop, a pallet, or a shelf tray.

Formats, functions, and when to use each

I group POP into five common forms. Floor displays take a big share. In one industry report, floor units held about 43.7% of POP share. I see that in stores. A tall stand with strong color can stop traffic. Countertop5 units sit by the cashier. They win impulse buys. Pallet displays ride in on the pallet. They drop in place at club stores. Tray or shelf displays clip into existing sets. They bring order and visibility. Hang tabs or clip strips pull small items into sight lines.

I pick the form by goal. If the goal is trial, I put a small tray near the core set. If the goal is a launch, I use a floor stand or pallet for reach. If the store is tight, I choose a slim “PDQ” shipper. I print clear claim blocks and barcode zones. I add simple assembly steps with large icons. I keep part counts low.

I also plan by region. In North America, the market is mature. The rules are strict, but stable. In Asia Pacific, growth is fast. Retail expands. E-commerce blends with stores. I design for fast turn and modular reuse. In Europe, I push recycled board, water-based inks, and no plastic lamination. That meets buyer demands for green. I also watch duty rates. A 2025 tariff wave lifted some import costs into the U.S. I plan local print where it helps lead time and cost.

| POP Type | Best Use | Shelf Life | Notes |

|---|---|---|---|

| Floor Display6 | Launch, big impact | 4–12 weeks | 43.7% share in some reports |

| Countertop | Impulse, small packs | 2–8 weeks | Near POS, small footprint |

| Pallet | Clubs, bulk | 4–8 weeks | Fast drop-in, high volume |

| Shelf/Tray | Line blocking, trial | 4–12 weeks | Uses existing shelf |

| Hang Tab/Strip | Add-on buys | 2–6 weeks | Light SKUs, eye level |

Why do merchandisers use pop displays?

Buyers see many brands. Shelf space is tight. A display can make a small brand look big. It can also make a big brand look new.

Merchandisers use POP to win attention, grow facings, speed setup, and tell a short story fast. The goal is velocity, not art. Good POP removes friction for shoppers and staff.

Jobs to be done and proof points

I write briefs with simple jobs. First, gain visibility. Second, guide choice. Third, hold stock. Fourth, meet the store’s rules. Fifth, leave a small footprint after life. When a unit does these jobs, sales lift follows. I track tests. A clean floor stand placed at the power aisle can drive strong trial. A PDQ tray near the core set can raise pick rate for a new flavor. I use QR codes for quick assembly videos. Store teams like that. They scan and build in minutes.

Sustainability7 is now a core job. Europe pushes it hard. U.S. chains ask more each year. I spec recycled fibers and water-based inks. I test nano coatings for splash zones. I keep mixed materials to a minimum so the unit can be recycled. Gen Z values this. The brand gains credit.

Speed matters. Digital print8 lets me ship short runs. I can localize art. I can print a unique code per store if needed. This cuts waste. It also helps one-to-one promotions. I see growth in Asia Pacific as retail spreads. I align with that by making modular kits. A brand can reuse the base and swap headers. This keeps cost low. It also helps carbon goals.

Here is how I map jobs to design:

| Job | Why It Matters | Design Choice | Metric |

|---|---|---|---|

| Visibility9 | Stops the shopper | Tall header, bold font | Dwell time |

| Guidance | Reduces confusion | 3-bullet story, big price | Conversion |

| Stocking | Avoids empty pegs | Strong shelves, locks | OOS rate |

| Compliance | Avoids chargebacks | Planogram fit, labels | Setup time |

| Sustainability | Meets buyer values | Recycled board, water inks | Recyclability % |

I also share a short story. I once rushed a seasonal floor stand for a beauty client. The print looked great. The structure was too complex. Store teams struggled. Half the units stayed flat for a week. Sales lagged. We learned. We rebuilt the stand with five parts, not eleven. We added a one-minute video. The next drop built in ten minutes. Sell-through doubled. Simple beats clever.

Who usually provides pop displays?

Many teams touch a display. The brand writes the brief. The agency builds the concept. The display maker turns it into a real thing. The retailer sets the rules.

POP displays are provided by display manufacturers or packaging converters, often working with brand teams, agencies, and retailers. Good providers offer design, prototyping, testing, and mass production with on-time delivery.

How to pick the right provider and align roles

I run a factory with three lines. My team offers design, 3D renders, free changes before approval, strength tests, and transport tests. We build the sample. We do mass runs after sign-off. We serve B2B buyers only. We ship repeat orders with small tweaks. This model lowers upfront cost. It also builds trust over time. Large corporate buyers, retail chains, franchise brands, and trading companies are our core clients.

I check five proof points when I choose partners myself. First, material strength10. I ask for board specs and test data. Second, print quality. I compare color targets to design files. Third, certifications11. I verify FSC and factory audits. Fourth, logistics and timing12. I ask for clear lead times and buffer plans. Fifth, service. I look at response speed and tech support. Some buyers face pain points. Slow replies. Late ships. Fake certs. Weak displays. Color drift. Transit damage. I attack these with strict incoming checks, color bars, drop tests, and sealed packs. I also lock materials for mass runs so the sample and the bulk match.

I map roles in one sheet:

| Role | Main Task | Deliverable | Risk if Weak |

|---|---|---|---|

| Brand | Brief, budget, timing | Clear KPIs | Scope creep |

| Agency/Design | Concept, story | Key visuals | Off-brand art |

| Display Maker | Structure, DFM, tests | CAD, sample | Failures in-store |

| Retailer | Rules, space | Guide, PO | Chargebacks |

| Logistics | Ship, track | Booking, POD | Late launch |

I plan growth around where demand rises. Asia Pacific grows fast with urban retail and e-commerce. North America stays steady, with strong club and mass formats. Europe leads in eco rules. I expect display packaging13 to grow from about USD 24.7B in 2025 to about USD 41.7B by 2035 at roughly 5.4% CAGR. Corrugated board could reach around USD 314B by 2034. Floor POP should stay a fast-growing slice due to strong visual impact. I design for this future. I add simple IoT options for stock checks. I test AR callouts for deeper info. I keep units modular to reuse parts and cut waste.

Conclusion

POP still works when it is simple, fast, strong, and on time. I design for impact, setup, and data. Then I measure and repeat.

Explore how flexible cardboard can enhance display designs and meet diverse brand needs. ↩

Learn about the benefits of incorporating recycled materials in your display designs for a greener approach. ↩

Understanding cost implications can help you make informed decisions for display projects. ↩

Discover the key factors that influence the effectiveness and sustainability of cardboard displays.. ↩

Discover insights on how Countertop displays can drive impulse purchases and enhance customer engagement. ↩

Explore this link to understand how Floor Displays can maximize visibility and impact in retail settings. ↩

Explore this link to understand how sustainability is reshaping retail packaging and meeting consumer demands. ↩

Discover how digital print technology can enhance retail marketing strategies and reduce waste. ↩

Learn why visibility is crucial for attracting shoppers and increasing sales in retail environments. ↩

Understanding material strength testing can enhance your product quality and reliability, ensuring better outcomes. ↩

Exploring essential certifications can help you choose reliable partners and ensure compliance with industry standards. ↩

Learning about logistics can optimize your supply chain, reducing delays and improving overall efficiency. ↩

Staying updated on display packaging trends can give you a competitive edge in attracting customers and enhancing brand visibility. ↩