I face budget pressure. I also want a fast setup. I know displays can be expensive. I need a simple answer first, then a plan that I can act on today.

Yes. Many retailers and brands sell or liquidate used fixtures and displays through surplus auctions, store remodels, fixture brokers, and local buy-sell channels. You should check size, wear, safety, and branding fit before buying, and plan refurbishment and logistics up front.

I will show what fixtures exist, how often stores change them, who sets them up, and what “product display” means. I will also share what I learned while running PopDisplay and helping buyers reuse and customize cardboard displays for new launches.

What are the types of fixtures used in retail stores?

I see the store as a toolbox. If I choose the right tool, I can move more product with less cost. If I choose wrong, I lose space, time, and money.

Retail fixtures include floor units, gondolas, shelves, pegboards, racks, waterfall arms, dump bins, pallet displays, countertop units, signage holders, end caps, and security hooks. Temporary POP options include cardboard floor displays, tray displays, PDQ shippers, and clip strips for impulse zones.

How I classify, select, and reuse fixtures

I break fixtures into three buckets. I use permanent, semi-permanent, and temporary. Permanent fixtures include metal gondolas, wooden cabinets, glass cases, and pegboard runs. They last for years and take capital. Semi-permanent fixtures1 include MDF towers and acrylic risers. They last for seasons and support brand blocks. Temporary fixtures include cardboard displays2 and PDQ shippers. They move fast and change often.

I buy used when structure is sound and refresh is cheap. I check load ratings, fasteners, paint chips, and missing uprights. I measure bay width and depth. I draw a simple planogram. I add clip strips or shelves where I need facings. I apply vinyl wraps or printed covers to match brand color. I require safe edges for customers.

I use cardboard displays when I need speed, low cost, and custom messaging. Cardboard fits well with seasonal or launch activity. It is easy to print, cut, and fold. It is also light and recyclable. In my factory, we build floor displays, countertop units, pallet skirts, tray displays, and hang-tab accessories. We run strength tests and ship flat-pack to reduce freight. In North America, demand is stable because retail is mature. In APAC, growth is fast because urbanization and new retail formats expand floor space. Europe pushes sustainability, so recycled fibers and water-based inks matter.

Quick reference: fixture types and best use

| Fixture type | Lifespan | Best for | Used-buy tips |

|---|---|---|---|

| Metal gondola | 5–10 years | Core aisles | Check uprights, feet, paint |

| Wooden cabinet | 3–7 years | Premium zones | Check hinges, finish |

| Glass case | 3–7 years | High value items | Check locks, crack risk |

| Pegboard & hooks | 5+ years | Small hangs | Match hole pitch |

| Dump bin | 1–3 years | Promotions | Check edges, stability |

| Pallet display | Weeks–months | Clubs & promos | Confirm footprint |

| Cardboard floor display | Weeks–months | Launch & seasonal | Verify load rating |

| Countertop display | Weeks–months | Impulse | Check footprint, height |

| Clip strip | Months | Cross-merch | Test spring and tabs |

How often should retailers change their displays?

I feel the pressure of deadlines. I know timing decides sell-through. I want a clear cadence that I can plan against with suppliers.

Retailers refresh temporary displays every 4–12 weeks, seasonal resets quarterly, and core fixtures annually or during remodel cycles of 3–7 years. High-traffic chains run weekly end-cap and PDQ swaps tied to promos and new products.

What drives refresh cycles3 and how I plan around them

I plan change by campaign, season, and category. Grocery and drug move fast. They swap end caps and PDQs weekly or bi-weekly. Mass and club schedule pallet drops around promotions. Specialty retail moves slower but still refreshes seasonal stories every quarter. Permanent fixtures change with remodels. Many chains follow a 3–5 year refresh of brand blocks and a 5–7 year full remodel.

In my plant, I back-plan from in-store week. I hold design lock at minus six weeks for domestic jobs and minus ten weeks for export jobs. I run prototype, strength, and transport tests. I approve color with drawdowns. I build ship sets by store. I pack flat. I use strong outer boxes and corner guards. I label by planogram. I book ocean or air depending on the deadline. I also plan buffer for customs and last-mile.

I see trends push faster cycles. Digital printing lets us run small lots with very fast changes. Brands use personalized graphics and region-specific offers. Sustainability also changes cycles. Buyers ask for recycled board, water-based inks, and lighter designs. They want the same strength with less fiber. APAC keeps growing, so more launches land there first. Europe sets standards for recyclability. The United States stays strong in clubs and big box where PDQ and pallet displays move volume.

Cycle planning cheat sheet

| Display type | Typical refresh | Notes |

|---|---|---|

| End cap | 1–4 weeks | Promo-driven |

| PDQ / Countertop | 2–8 weeks | Impulse zones |

| Floor cardboard | 4–12 weeks | Launch windows |

| Pallet club | 2–6 weeks | High velocity |

| Semi-permanent tower | 6–12 months | Brand block |

| Core gondola | 1–3 years | Assortment resets |

| Full remodel | 3–7 years | Capex cycle |

Who sets up store displays?

I want clean execution. I know a great design fails if setup is slow or wrong. I need to know who owns the job and how I make it easy.

Displays are set up by a mix of in-store associates, third-party merchandising teams, field reps, or installers. For cardboard and PDQ units, I design flat-pack kits with simple steps, clear labels, and QR instructions to speed safe setup.

How I design for fast, correct setup in the field

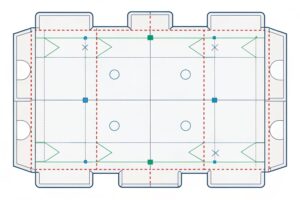

I design for three truths. Time is short. Space is tight. People change shift. So I reduce steps. I print step-by-step on the shipper. I add QR codes to a 60-second video. I number trays and dividers. I use tool-free locks4 and tab-slot joints. I avoid hidden tabs. I test with a first-time user in my sample room. If they fail, I fix the structure, not the person.

Who does the work depends on chain and program. In grocery and drug, store associates build many PDQs during stocking. In mass and specialty, third-party merchandisers install big sets on reset nights. For club pallets, the warehouse team drops full pallets. For premium towers, field reps or pro installers handle power, security, and compliance. I ship a master pack that fits each model. I include extra shelf strips and hang tabs. I pack a small hardware kit even for tool-free designs.

I check store constraints. I confirm bay height, fire code, and ADA. I confirm peg pitch and shelf thickness. I confirm floor load if product is heavy. I add safety notes on weight and center of gravity. I use water-resistant coatings5 or films when the display sits near doors. I avoid mixed materials that block recycling. I choose recycled corrugated and water-based inks so the store can break down and bale after the run.

Setup responsibility map

| Channel | Typical installer | My design response |

|---|---|---|

| Grocery/Drug | Store staff | 5-minute build, big labels |

| Mass | Merch team | Pallet-ready, pre-filled options |

| Club | Warehouse staff | Full pallet, no loose parts |

| Specialty | Field reps | Premium finishes, locks |

| Events/Pop-ups | Installers | Road-case pack, re-use |

What is product display in retail?

I want a clear definition. I want to align my team and my buyer. I want everyone to measure the same goal.

A product display is the planned mix of structure, graphics, and placement that presents products to drive awareness, consideration, and sales. It includes fixtures, messaging, planograms, and a reset calendar tied to promotions and seasons.

How I define, measure, and improve a display

I use a simple frame. Structure holds. Graphics speak. Placement sells. Structure must carry product safely. Graphics must show brand, benefit, and price. Placement must match traffic. I write a one-page brief that lists product dimensions, load per shelf, total facings, callouts, and target aisle. I sketch a planogram6. I pick corrugated board grades based on weight. I choose single-wall or double-wall. I choose coatings if I need water or UV resistance.

I measure basics. I track sell-through7 by week. I track compliance photos on day one. I track damage rates in transit. I track build times. I track reorders. I look for color match issues. I use water-based inks and tight color control. I sign off drawdowns under store lights. I use ICP or spectro checks when budget allows. I also plan for logistics. I ship flat. I reduce air volume. I use modular inserts. I follow tariffs and costs. In 2025, U.S. tariffs on some imported items rose, so I model landed cost early. I keep margins by improving yield and trimming waste.

This is where a personal story guides me. I once supported a hunting brand launch for crossbows and accessories. The buyer was David from Barnett Outdoors. He had strict dates and high design needs. He asked for PDQ shippers for clubs and floor displays for mass. My team built prototypes fast. We ran strength tests for heavy boxed items. We adjusted the locking tabs to stop lean. We swapped to a recycled board with a nano coating that resisted scuffs. We hit a tight delivery to the U.S. and Canada. The program sold well, and reorders covered the upfront design cost. The lesson was simple. Clear briefs and fast changes win.

Display components and checkpoints

| Component | What I define | Checkpoint |

|---|---|---|

| Structure | Board grade, joints | Load test |

| Graphics | Brand, claims, UPC | Color drawdown |

| Planogram | Facings, rows | Photo proof |

| Placement | Aisle, end cap, club | Traffic check |

| Timeline | Design, sample, ship | Back-plan milestones |

| Sustainability | Recycled fiber, inks | Recyclability note |

Conclusion

I can buy used fixtures when they fit my plan. I refresh on a set cadence. I assign setup to the right team. I define displays clearly and measure what matters.

Explore this link to understand the long-lasting benefits and applications of permanent fixtures in retail environments. ↩

Discover how cardboard displays can enhance marketing strategies and provide cost-effective solutions for seasonal promotions. ↩

Understanding refresh cycles is crucial for effective retail planning and can enhance your strategy. ↩

Explore how tool-free locks enhance efficiency and ease of setup, making installations faster and more user-friendly. ↩

Learn about the significance of water-resistant coatings in protecting displays, especially in high-moisture environments. ↩

Exploring planograms can enhance your display strategy and improve product placement. ↩

Understanding sell-through is crucial for optimizing inventory and maximizing sales. ↩