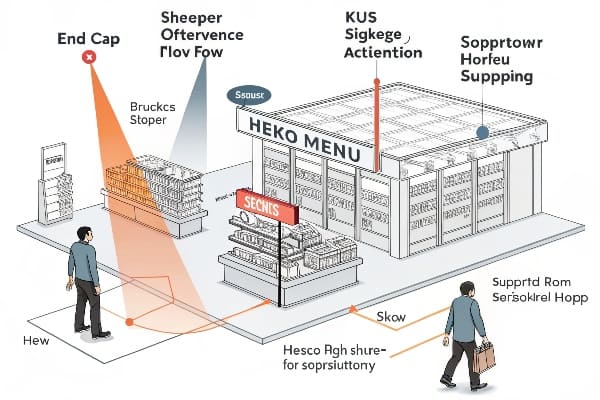

Why use an endcap display?

Shoppers move fast. Aisles feel crowded. I need a tool that stops people and sells in seconds. Endcaps do this job every day.

An endcap display turns foot traffic into sales by placing a bold offer at aisle ends; it boosts visibility, reduces choice overload, supports promos and launches, and moves inventory fast with low setup cost.

I see endcaps work in many chains and categories. I use them to win attention when shoppers decide where to look next. I keep the story simple. I keep the setup practical. I build for speed.

What is the purpose of an endcap display in retail?

People enter an aisle and pause at the turn. I use that pause. I present one clear idea. I help the shopper act now.

An endcap’s purpose is to intercept traffic, present one simple value story, and convert quick interest into quick sales while supporting promotions, seasonality, and launches without changing base shelf plans.

How endcaps shape the path to purchase

I treat an endcap as a small stage. It sits outside the noise of the shelf. It gives me a clean frame for one message. I place a hero product1 at eye level. I add one strong price point or bundle. I avoid clutter. I make the color and typography readable from six feet. I use corrugated cardboard when I need speed, low cost, and easy custom shapes. I flat-pack it to save freight. I use water-based inks to keep it sustainable2. I add a QR code when I want quick content. I design joints that set up in minutes, because staff time is tight. I test the structure with load and transport checks. I keep a refill path simple, so the display looks full.

| Purpose | Tactic | KPI to watch |

|---|---|---|

| Intercept traffic | Place at aisle ends near high-flow paths | Dwell time trend |

| Tell one story | One headline, one hero, one price | Message recall rate |

| Convert now | Easy reach, clear price label, no barriers | Unit lift vs shelf |

| Support promo | Seasonal color, coupon tear-pad, QR to offer | Redemption rate |

How is an end cap an effective display?

I want results, not just photos. I build for the way eyes scan and hands move. I remove friction. I make it obvious.

An end cap is effective because it combines prime location, simple design, and clear value; it reduces choices, shortens the path to grab, and boosts confidence with price and proof.

Design rules that drive results

I start with contrast3. The header carries a five-to-seven word promise. The hero pack sits center. Support SKUs flank it. I avoid more than three price points. I keep the shelf edge clean. I use a sturdy corrugated grade that matches the weight. I add hidden supports if the category is heavy, like liquids or tools. I spec water-resistant coatings only when needed, because I want to keep recyclability. I print digitally for small runs or local tests. I switch to offset when volume grows. I add a small how-to panel when the item needs guidance. I place a secondary callout for “new,” “limited,” or “save.” I make the bottom shelf a stock bay to enable quick refill. I add a discreet restock label so staff know the planogram.

| Element | Why it works | Build tip |

|---|---|---|

| Big header | Signals value fast | Use high contrast and plain language |

| Hero product | Reduces choice and guides reach | Face-out, eye-level, well lit |

| Price badge | Removes doubt and speeds decisions | One dominant price, avoid clutter |

| Tray/insert | Keeps packs tidy and easy to grab | Use PDQ trays for speed and stability |

| QR/claim | Adds proof or demo in small space | Link to a short video or review snapshot |

What is the purpose of end caps?

I use end caps to meet joint goals. Brands want trial and share. Retailers want basket, margin, and clean execution. We meet in one frame.

End caps exist to align brand stories and retailer outcomes: build awareness, drive trial, raise basket, clear seasonal goods, and test new products without reworking the base shelf.

Brand and retailer goals in one place

I map the goal first. If I need trial, I push a single-size offer with a sharp price. If I need trade-up, I feature a premium bundle4 with a clear benefit. If I need basket, I pair items that solve one task. If I need to clear seasonal stock5, I lead with urgency and value. I also think about labor. I design tabs, slots, and pre-glued joints that store teams can build fast. I add clear “Step 1–2–3” icons on the shipper. I put a small compliance photo so managers know when it is right. I track results weekly. I adjust artwork or packout for the next wave. I do this often in North America, where retail is mature and speed matters.

| Goal | Message style | What I measure |

|---|---|---|

| Awareness | New + simple benefit | Reach, views, photo checks |

| Trial | Intro price or bonus pack | Unit velocity, repeat buy |

| Trade-up | Better spec, clear proof | Mix shift to premium |

| Basket build | Complementary items | Avg items per basket |

| Seasonal clear | Urgency and big value | Sell-through by week |

How effective are end caps?

I see strong lifts when we keep the story simple. I see weak lifts when we turn the display into a shelf. Focus decides the result.

End caps are highly effective when they feature one hero, one benefit, and one price; they often deliver clear, repeatable sales lift versus base shelf when kept full and compliant.

Where the lift comes from and how I track it

I watch the path. Traffic flows near the endcap, so small gains in conversion6 create big wins. I design for fast recognition at three distances: ten feet (color and shape), six feet (headline and price), and two feet (details and grab). I track baseline units per store per week before activation. I compare to active weeks. I check refill rates and photo compliance, because an empty bay kills the test. I look at returns on materials and labor. I weigh corrugated cost against sell-through7 speed. Digital print helps me test. Offset helps me scale. I include a small UTM on a QR for content views when the item needs education. I accept that some weeks will dip due to season or weather. I plan resets with store calendars.

| Metric | Why it matters | Practical target idea |

|---|---|---|

| Unit lift vs shelf | Core signal of demand shift | Sustained positive trend |

| Sell-through | Ties to cash and inventory health | Clears within promo window |

| OSA / compliance | Ensures design can actually work | Daily photo check, refill plan |

| Labor minutes | Impacts rollout scale and margins | Under 15 minutes to set |

| Damage rate | Protects margin and brand | Near zero with right grade |

What is the goal of a good end cap family dollar?

Family Dollar serves value-driven trips. Shoppers want clear prices and easy picks. I design for speed and trust.

The goal is fast turns on value SKUs with bold price signs, seasonal relevance, simple setup, and strong compliance; it must look clean, refill fast, and match the planogram and price point rules.

Build for value shoppers and tight labor

I focus on price perception8 first. I use big, plain numbers. I keep colors in the store palette so the set feels native. I keep copy simple. I avoid long claims. I choose sturdy trays since value packs can be heavy. I make sure packs face forward and can be grabbed with one hand. I keep the vertical stack short to reduce strain. I design a single-piece header to cut setup steps. I add pre-packed PDQ trays9 so staff slide and go. I label each tray with SKU, facing count, and reorder code. I design for low shrink by keeping items visible and tidy. I test the set in a small cluster before a wider drop, because store footprints vary.

| Component | Best practice at Family Dollar | Notes |

|---|---|---|

| Price sign | Large numerals, simple cents | One main price per endcap |

| Packout | PDQ trays with clear facings | Slide-in, zero tools |

| Assortment | Fast movers + seasonal tie-in | Limit to 3–4 SKUs |

| Color and type | High contrast, plain fonts | Readable from six feet |

| Refill path | Stock bay at bottom | Daily top-off |

What is an important practice that will ensure your end caps generate as much sales as possible?

I learned one simple rule after many launches. When I follow it, results hold. When I ignore it, results fade.

Follow “one message, one hero, one price,” then refill daily; this keeps the story clear, removes choice overload, and ensures the display looks full, which protects conversion and momentum.

The discipline that protects sales

I write the headline first. I choose the hero next. I set one lead price. I remove extra claims and tiny logos that steal space. I design the tray so the last unit still looks neat. I add a small stock bay or back-up shippers for quick refill. I give stores a simple photo of “what good looks like.” I set a daily refill10 reminder during the promo window. I keep the structure recyclable and light, because this reduces cost and helps sustainability goals. I keep print runs flexible with digital print for tests. I switch to offset when orders repeat. I accept small trade-offs to keep assembly simple. I keep the supply plan tight, because late arrivals lose the window.

| Do | Why it matters | How I do it |

|---|---|---|

| One message/hero/price | Removes doubt and delay | 5–7 word header, big numerals |

| Daily refill | Keeps conversion steady | Assign task, add shelf label |

| Flat-pack and quick setup | Saves labor and reduces damage | Pre-glued tabs, 3-step guide |

| Right corrugated grade | Prevents sag and returns | Test with load/transport checks |

| Sustainable inks/coatings | Meets buyer expectations | Water-based when conditions allow |

Conclusion

Endcaps work when they stay simple, stay full, and stay fast. I design for clarity, speed, and trust. Then I measure, learn, and scale what wins.

Understanding hero products can enhance your marketing strategy and improve sales by focusing on key items. ↩

Exploring sustainable practices in retail can help you reduce environmental impact and attract eco-conscious consumers. ↩

Understanding contrast can enhance your design skills, making your work more effective and visually appealing. ↩

Explore this link to understand how premium bundles can enhance customer value and drive sales. ↩

Learn strategies for clearing seasonal stock efficiently, maximizing your inventory turnover and profits. ↩

Explore this link to discover proven strategies that can significantly enhance your conversion rates and boost sales. ↩

This resource offers valuable insights and techniques to optimize your sell-through rates, ensuring better inventory management. ↩

Understanding price perception can help you optimize your pricing strategy and attract more value shoppers. ↩

Exploring PDQ trays can enhance your store’s efficiency and improve product visibility, making shopping easier for customers. ↩

Exploring this link will reveal how daily refills can enhance sales consistency and customer satisfaction. ↩